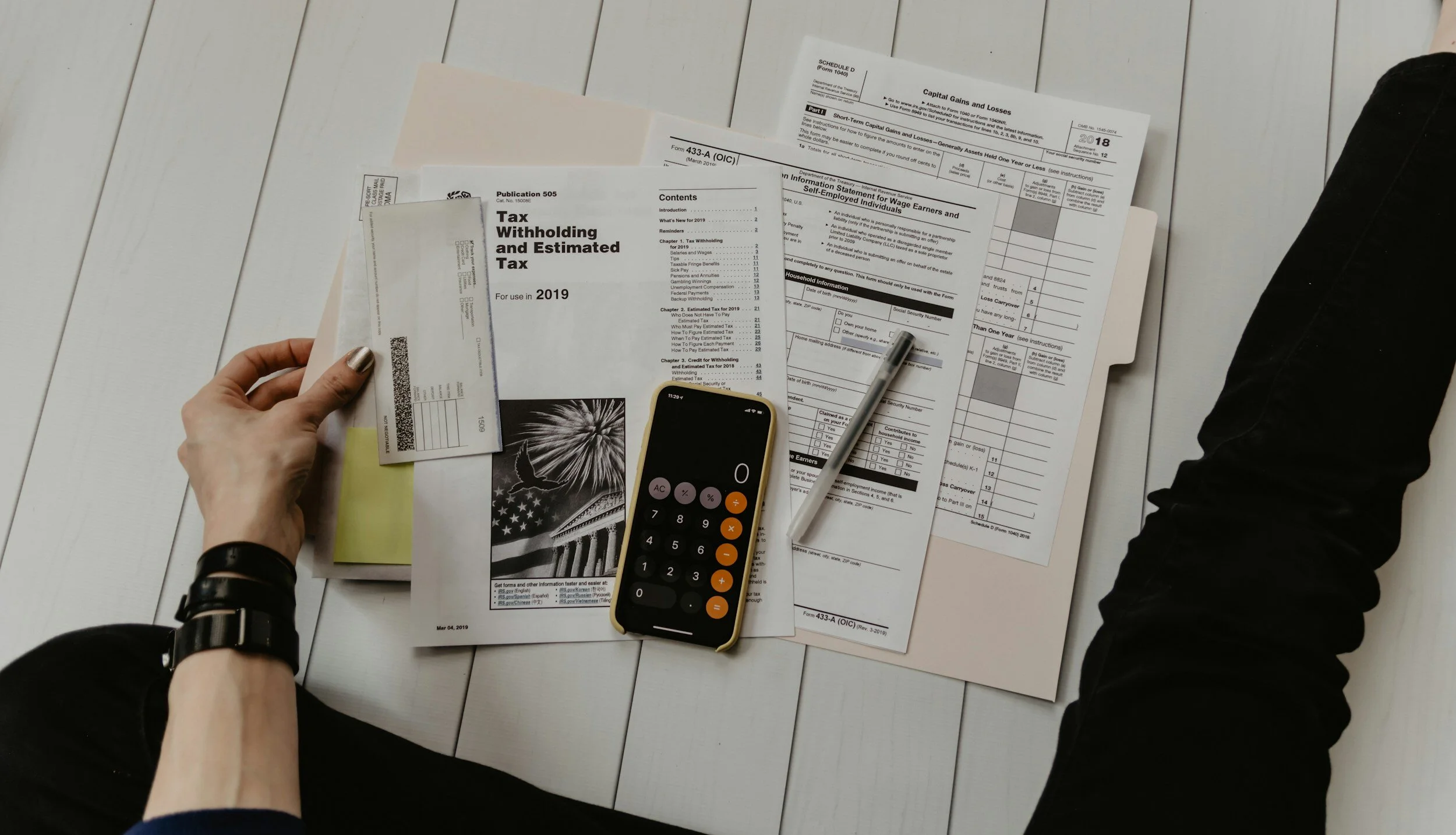

Owning a home comes with numerous financial advantages, including various tax benefits that can help homeowners save money and maximize their financial well-being. In this blog, we’ll explore 6 tax benefits available to homeowners in Massachusetts.

1. Mortgage Interest Deduction

One of the most significant tax benefits for homeowners is the mortgage interest deduction. Homeowners can deduct the interest paid on their mortgage loan, up to a certain limit, from their taxable income. This deduction applies to both primary and secondary residences and can result in substantial tax savings, especially in the early years of a mortgage when interest payments are higher.

2. Property Tax Deduction

Homeowners can also deduct property taxes paid on their primary and secondary residences from their taxable income. This deduction helps offset the costs of property ownership and can result in significant savings, particularly in areas with higher property tax rates.

3. Home Equity Loan Interest Deduction

Interest paid on home equity loans or lines of credit (HELOCs) used for home improvements, renovations, or other qualified purposes may be tax-deductible. This deduction can provide additional savings for homeowners who leverage their home equity for financial needs.

4. Capital Gains Exclusion

When homeowners sell their primary residence at a profit, they may qualify for the capital gains exclusion. Individuals can exclude up to $250,000 of capital gains ($500,000 for married couples filing jointly) from their taxable income if they have owned and used the home as their primary residence for at least two out of the past five years.

5. Energy Efficiency Tax Credits

Homeowners who make energy-efficient improvements to their homes, such as installing solar panels, energy-efficient windows, doors, or HVAC systems, may be eligible for federal tax credits. These credits can help offset the costs of energy-efficient upgrades.

6. Home Office Deduction

Self-employed individuals or those who work from home may qualify for the home office deduction. This deduction allows homeowners to deduct a portion of their home-related expenses, such as mortgage interest, property taxes, utilities, and maintenance costs, based on the percentage of their home used exclusively for business purposes.

Conclusion

Homeownership offers a range of tax benefits that can help homeowners save money and reduce their tax liabilities. From deducting mortgage interest and property taxes to leveraging home equity and energy-efficient improvements, homeowners have several opportunities to optimize their tax situation. It’s essential for homeowners to stay informed about tax laws, consult with tax professionals or financial advisors, and take advantage of available tax benefits to maximize their financial advantages and savings.